aurora co sales tax rate 2021

This is the total of state county and city sales tax rates. Automating sales tax compliance can help your business keep compliant with changing.

2021COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY.

. Aurora 44202 Portage 700. You can print a 85 sales tax table here. 4 rows Rate.

6 rows The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax. Aurora co sales tax rate 2021 Thursday February 24 2022 Edit. Fast Easy Tax Solutions.

The 2018 United States Supreme Court decision in South Dakota v. 80017 - County sales and use tax rates - 2021 Arapahoe County Colorado State. 80017 zip code sales tax and use tax rate Aurora Arapahoe County Colorado.

Note that failure to collect the sales tax does not remove the retailers responsibility for payment. Aurora-RTD 290 100 010 025 375. Monthly if taxable sales are 96000 or more per year if the tax is more than 300 per month.

80041 - city sales and use tax rates - 2021 Aurora Arapahoe County Colorado State. Colorado has state sales tax of 29 and allows local governments to collect a. POST OFFICE ZIP CODE COUNTY RATE POST OFFICE ZIP CODE COUNTY RATE PAGE 2 REVISED January 1 2021 Dennison 44621.

Wayfair Inc affect Colorado. Did South Dakota v. 275 lower than the maximum sales tax in IL.

Aurora property tax rates are the 9th lowest property tax rates in Ontario for municipalities with a population greater than 10K. Best 5-Year Variable Mortgage Rates in Canada. What is the sales tax rate in Aurora Colorado.

ENTITY STATE RTD CD COUNTY CITYTOWN TOTAL. Essex Ct Pizza Restaurants. The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special tax.

This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing. This is notan all inclusive list. The following list of Ohio post offices shows the total county and transit authority sales tax rates in most municipalities.

Estimated County Tax Rate. Annually if taxable sales are 4800 or less per year if. Sales tax and use tax rate of zip code 80016 is located in aurora city douglas county colorado state.

Wholesale sales are not subject to sales tax. Delivery Spanish Fork Restaurants. Ad Find Out Sales Tax Rates For Free.

Income Tax Rate Indonesia. Restaurants In Matthews Nc That Deliver. The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104.

Austinburg 44010 Ashtabula 675. Aurora in Illinois has a tax rate of 825 for 2022 this includes the Illinois Sales Tax Rate of 625 and Local Sales Tax Rates in Aurora totaling 2. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

Pin By Techguruplus On Youtube Vdos In 2021 Youtube Youtube Videos Krementz Lariat Slide Necklace Clear Rhinestones Etched Leaves Silver Tone 1950s Vintage Clear Rhinestones Vintage Costume Jewelry Necklace. The state sales tax rate in Colorado is 2900. The average sales tax rate in Colorado is 6078.

New 2021 Volkswagen Jetta RLine for sale in Aurora CO. Year Municipal Rate Educational Rate Final Tax Rate. Aurora co sales tax rate.

80041 zip code sales tax and use tax rate Aurora Arapahoe County Colorado. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora. Sales Tax and Use Tax Rate of Zip Code 80041 is located in Aurora City Arapahoe County.

With local taxes the total sales tax. Method to calculate Arapahoe County sales tax in 2021. The Aurora Colorado sales tax is 290 the same as the Colorado state sales tax.

There is no applicable county tax. The estimated 2022 sales tax rate for 80011 is. With CD 290 000 010 025 375.

For tax rates in other cities see Colorado sales taxes by city and county. Residential Property Tax Rate for Aurora from 2018 to 2021. Retail Sales 2 Revised August 2021 Colorado imposes a sales tax on retail sales of tangible personal property prepared food and drink and certain services as well as the furnishing of rooms and accommodations.

While Colorado law allows municipalities to collect a local option sales tax of up to 42 Aurora does not currently collect a local sales tax. Sales Tax and Use Tax Rate of Zip Code 80017 is located in Aurora City Arapahoe County. The 825 sales tax rate in Aurora consists of 625 Illinois state sales tax 125 Aurora tax and 075 Special tax.

Footnotes for county and special district tax. The Colorado sales tax rate is currently. Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month.

The County sales tax rate is. Soldier For Life Fort Campbell. Aurora co sales tax rate.

Has impacted many state nexus laws and sales tax collection requirements. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. Opry Mills Breakfast Restaurants.

Aurora Co Sales Tax Rate 2021. The Aurora sales tax rate is. Estimated City Tax Rate.

To review these changes visit our state-by-state guide. This Part 1 outlines criteria for determining. You can print a 825 sales tax table here.

The minimum combined 2022 sales tax rate for Aurora Colorado is. None if net taxable sales are greater than 100000000.

Kansas Sales Tax Rates By City County 2022

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Solving Sales Tax Applications Prealgebra

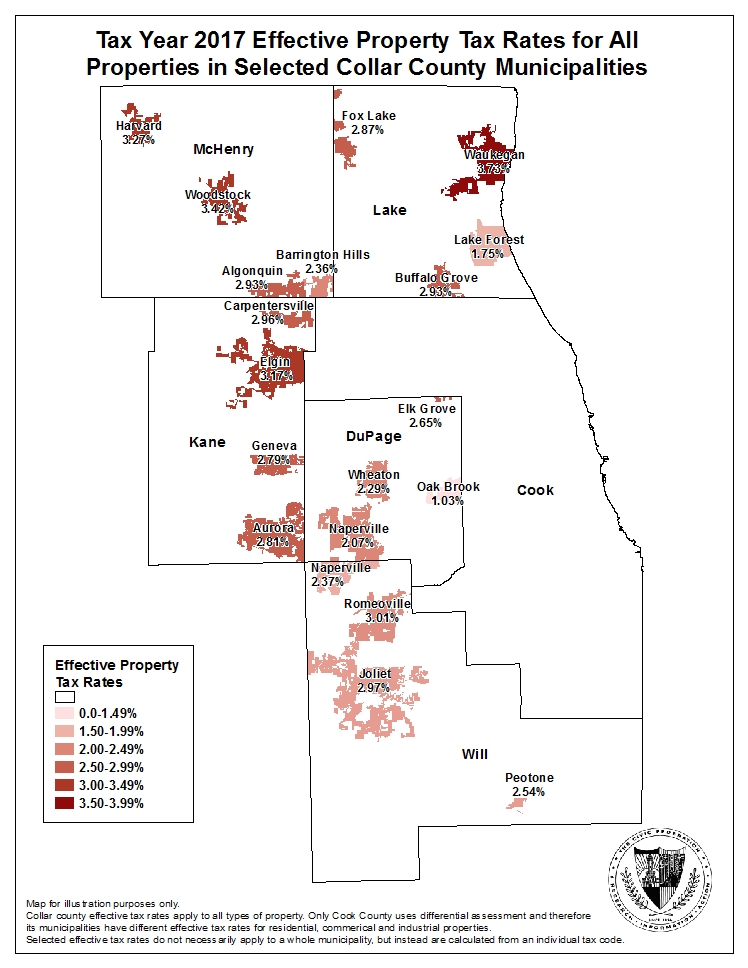

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

How To Pay Sales Tax For Small Business 6 Step Guide Chart

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

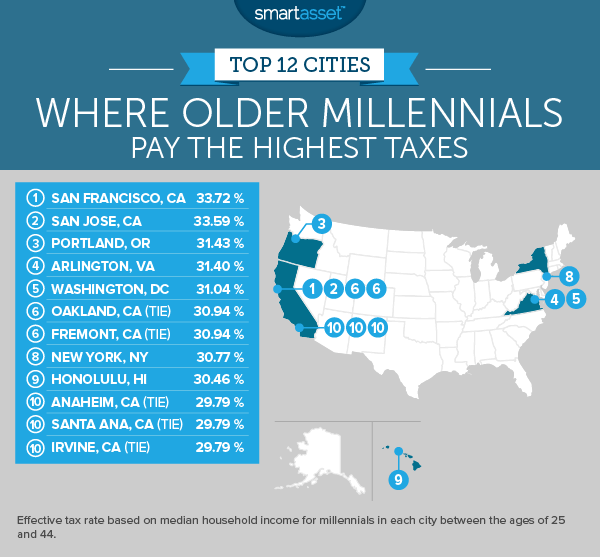

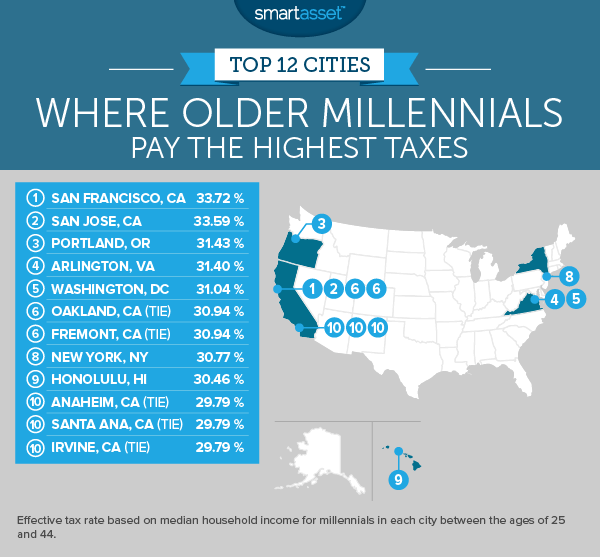

Where Millennials Pay The Highest Taxes 2017 Edition Smartasset

Colorado Sales Tax Rates By City County 2022

The Income Tax Rate In Colorado Is 4 63 This Is Not The Only Tax You Will Pay On Your Earnings

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute